Understanding the Future of Artificial Intelligence in Finance

23rd May, 2023 5 minutes

Financial services companies have always been at the forefront of implementing new technologies, particularly with the birth of the internet—and the eCommerce industry that sprang up within it—which demanded an infrastructure of payment handling, data processing and security. However, the speed and magnitude of these technological advances have increased in recent years, thanks to the widespread adoption of artificial intelligence in finance.

Everyone has benefited from the growth of AI and machine learning technologies. From increasingly autonomous vehicles that can assist drivers with parking and commuting safely in slow traffic to machine learning algorithms enabling pharmaceutical organisations to develop new treatments quickly, new artificial intelligence tools are helping people live longer and handle rote tasks more efficiently.

The finance and retail sectors are noted to be the largest investors in emerging AI, machine learning and Internet of Things (IoT) technologies. Beyond operational efficiencies and cost savings, the sheer volume of data available to financial services and FinTech organisations means that investment, customer service, risk management and compliance are all transformed.

Businesses are not the only ones with access to this information, however. As a result of the various forms of legislation surrounding privacy, consumers are increasingly becoming data-savvy. Young people, in particular, use this information for more fine-grained control of their finances.

Business leaders often discuss how these technologies are helping their organisations to enhance productivity, make operations leaner, and increase long-term resilience, but what are some examples of artificial intelligence in finance?

What is Artificial Intelligence?

Before we explore artificial intelligence in finance, it’s a good idea to understand what is meant when we use the term. With the waves that technologies like ChatGPT are making in certain industries, we’re encountering the term more often these days, even in conversation with people unfamiliar with the formerly niche field of AI research and development.

There’s no short answer to the question, “What is artificial intelligence?”. It encompasses a number of technologies that are both available and in the R&D pipeline.

Many explanations suggest that the field is concerned with building machines and software that can display human intelligence. Still, as we have seen over the last few years, AI is often focused on achieving super-human feats, processing information or carrying out laborious tasks more quickly than any individual person could.

This means that AI-enabled tech is becoming a valuable tool within any sector that leverages vast amounts of data or has strict reporting requirements. There are several active areas of AI which are making an impact on our professional and personal lives, such as:

Machine learning

The training of software and building of algorithms that can dynamically learn to automate data analysis and discover patterns in large volumes of information.

Deep learning

A sub-field of machine learning focused on object and image-recognition technologies, which have become increasingly popular in digitising and parsing through historical paperwork and physical files and in “face-unlocking” implementations in mobile banking.

Natural language processing

The building of machines that can understand human speech in real-time, most recognisable with the digital mobile assistants we carry daily, such as Apple’s Siri.

Internet of Things

The interconnection of appliances, vehicles, wearables and buildings through the use of numerous sensors to automate various aspects of our lives, such as internet-enabled espresso makers, which can connect with our phones to begin brewing coffee as our morning alarms go off.

Robotics

Increasingly popular in the clinical and life sciences environments, as well as in manufacturing, robotics are helping to process samples faster and enable scientists to focus on research tasks, as well as leading the way in ground-breaking prosthetic limbs.

Artificial intelligence sets itself apart by being able to learn in either an unsupervised, supervised or reinforced manner. Unsupervised learning—as it sounds—involves no external feedback from the AI developers, whilst supervised learning is, of course, the opposite, with developers using direct feedback to improve the intelligence of their AI technology. Reinforced learning involves training an AI for a specific task and then allowing it to execute that task repeatedly to maximise efficiency.

What is the Future of Artificial Intelligence in Finance?

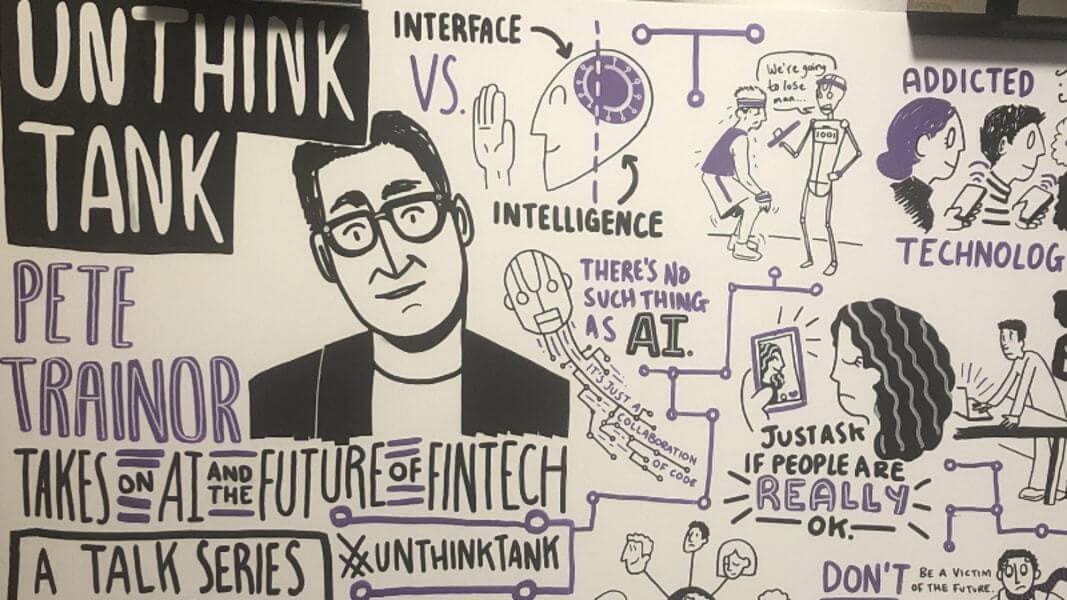

Whilst artificial intelligence and machine learning technologies are already driving innovation in several areas of the financial services and FinTech industries, including in anti-money laundering and fraud detection, it’s still the case that many of these exciting developments are in their infancy. That’s where the Unthink Tank comes in. This event series invited leaders from the tech and creative communities to discuss issues surrounding the new technologies which empower them.

One of our FinTech Consultants, reflected on the event, helmed by technologist and co-founder of Us AI, Pete Trainor:

“This event explored AI's growing role in our everyday lives, particularly surrounding mental health and money. Pete’s talk on the future of artificial intelligence in finance was a fascinating look at the use of AI as a tool to identify not only exposure to risk and compliance issues within organisations but also as a means of identifying risks to their users’ mental health and well-being.

Using indicators like credit card debt or unusual spending habits can be more easily identified via these new technologies. As a result, businesses are able to offer better help and hopefully prevent any harm to the user, with a real emphasis being placed on reducing suicide rates…”

Events such as Unthink Tank are where we can explore the future impacts of AI in FinTech and the disruptive potential for these technologies to enable organisations to reduce harm and carry out an incredibly positive function within society. Our consultant continues:

“Firstly, I think the idea of using AI technologies to save lives is absolutely brilliant and can only be applauded. I also think the tech involved is very cool—the ability of self-evolving AI systems to learn what is and isn’t normal behaviour, and then to use that behaviour to reduce harm is fantastic, as is Pete’s idea of ‘minimum viable personality’, ensuring that AI and machine learning technologies are focused on solving societal and human issues.”

Alongside these socially positive implementations of artificial intelligence in finance, AI and machine learning technologies are also helping to secure customers’ money through the development of anti-money laundering and fraud detection software which can learn and become smarter—keeping on top of the increasingly rapid change of tactics which cybercriminals are employing.

Image-recognition software is helping to make mobile banking easier, with users now able to unlock their accounts with their front-facing cameras, whilst chatbots and virtual assistants are able to answer complex questions and direct customers to the most suitable support option.

Within trading, AI uses historical information to guide investment activities and dynamically reacts to up-to-date data from various sources, including social media, news reports, earnings numbers, and government announcements. Natural language processing (NLP) enables software to scour the web for the latest discussions of mergers and acquisitions, whilst robo-advisory platforms are automating the leg-work of financial and asset management.

The biggest challenge to implementing this kind of technology is deciding where we choose to draw the line between support and surveillance—an increasingly complex task given our globalised world. As AI advances, these kinds of issues are going to become more prevalent. Pete Trainor highlighted this issue in his discussion at the Unthink Tank event by posing one final, difficult question:

“Is one person’s life worth more than the privacy of 99 others?”

It’s not only a question of support and surveillance, however, but also a question of how AI technologies will disrupt and evolve a number of FinTech jobs that we need to consider.

Why FinTech Jobs Will Be Revolutionised

Borrowing from an old analogy about the web, if the internet is a highway, the various forms of transaction and financial data are the vehicles speeding by. Increasing amounts of this data are passed into online systems each day. As a result, cybersecurity and automation have become key trends amongst FinTech jobs in the last few years. Protecting customers’ information in an age where eCommerce reigns is a key priority.

Similarly, compliance teams are being empowered by NLP-enhanced document summarisation technologies, enabling them to respond rapidly to the latest legislation and prepare reports which will allow them to reduce their employer’s exposure to risk.

Regulatory technology—or RegTech—professionals will be in high demand as new regulation is developed to manage the ground-breaking technologies that FinTech companies are bringing to the market and the subsequent increase in online transactions that will occur.

Low-code AI software will enable career progression we can only now imagine within the financial services sector, with the ability to learn the latest toolsets becoming a sought-after skill by companies sourcing candidates for their vacant FinTech jobs.

As Pete Trainor’s talk at Unthink Tank explored, disruptive FinTechs will not only be looking for skilled professionals to fill existing roles, but they’ll be creating new roles, too, drawing upon the skills of professionals with backgrounds in psychology and ethics to understand how best to support customers with money woes.

AI and machine learning are bringing financial services into the 21st century, and innovative organisations and start-ups are shaking up the common conception of the industry by implementing customer-centric approaches in their working practices.

Discover Cutting-Edge FinTech Jobs with Understanding Recruitment Navigating the complex world of machine learning, AI, and FinTech jobs can be overwhelming. That's why Understanding Recruitment is here to help. Our consultants provide tailored support to candidates seeking positions within the financial services industry, ensuring a smooth hiring process from application to onboarding. Contact us today to discuss your long-term career ambitions and discover exciting opportunities.